DNB FUND – HIGH YIELD

The fund return was positive in April, driven by coupons and some spread tightening. Energy related names continued to be positive contributors. On the negative side, the real estate sector can be mentioned. There were no new defaults during April.

OUTLOOK

We continue to view risk-reward as good on a medium to long term basis. Current yield levels offer good protection against company specific events, but continued volatility in international markets may affect the Nordic high yield market.

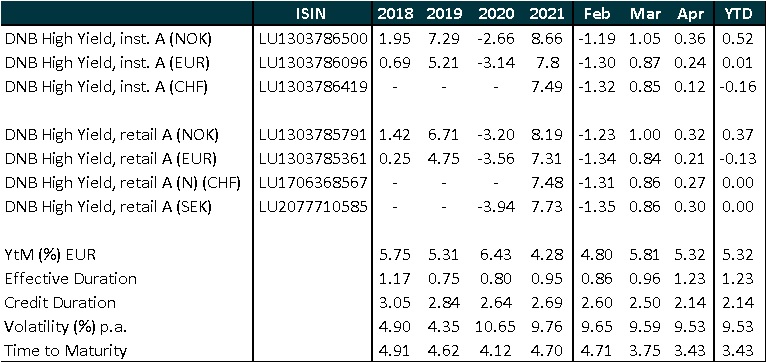

All data net of fees, as of 31/03/2022

You may also find our other fund reports via the links below. For any enquiries, we invite you to get in touch with your sales contact or to send an email to funds@dnb.no.

Equity funds:

- DNB Renewable Energy: SFDR Article 9 environmental & impact investing (Factsheet)

- DNB Nordic Equities: Actively managed in a stable Nordic universe with a green tilt (Factsheet)

- DNB Technology: Global value-oriented bottom-up technology fund (Factsheet)

- DNB Future Waves: Blue Economy, SDG investing (Factsheet)

- DNB Disruptive Opportunities: Identifying disruptive trends in the future (Factsheet)

Fixed income funds:

- DNB Nordic Investment Grade: Pure Nordic corporate investment grade bond fund (Factsheet)

- DNB Nordic Flexible Bonds: Pure Nordic corporate bond fund with both exposure to investment grade & high yield (Factsheet)

Germany, Austria & Switzerland

Mike Judith | Managing Director

mike.judith@dnb.no | +352 45 49 45 503