What happened

Following the U.S. elections, Bitcoin has reached a new all-time high, now trading slightly above $90'000. There is no discussion about the interest of Trump in digital assets, as proven again by the rumours of the acquisition of Bakkt by Trump Media & Technology Group Corp. But beyond Trump, the cryptocurrency industry has lobbied extensively to back the most crypto-friendly candidates across the party lines at the Congress. Therefore, it would be reductive to consider the Bitcoin's rally as a short-term "Trump trade".

Blockchain-related stocks benefit from Bitcoins's surge. Retail investors arre trading more actively, boosting the revenues of exchanges like Coinbase Global Inc. Bitcoin miners are seeing higher compensation due to increased rewards, and treasury firms like MicroStrategy Inc are witnessing an increase in the value of Bitcoin on their balance sheets.

Impact on our Investment Case

Concrete changes for the ecosystem

Trump aims to build a crypto-army and make the U.S. the "crypto capital of the planet". However, this ambitious goal requires the backing of a supportive Congress to enact the necessary regulatory framework. Unlike Europe and its MiCa framework (the equivalent of MiFID for crypto-assets), the United States still lacks a regulation that defines digital assets and the roles of the various participants in the blockchain ecosystem, as well as protecting investors.

The Securities and Exchange Commission's influence over the crypto industy is expected to diminish. The current "regulation-by-enforcement" approach may be reevaluated, especially with the potential appointment of a more crypto-friendly chair to replace Gary Gensler. Oversight of digital assets could shift to the Commodity Futures Trading Commission (CFTC), which has taken a more constructive stance, particularly in the debate over wheter cryptocurrencies qualify as securities.

Bitcoin miners may benefit from a federal "right-to-mine" policy. Similar protections already exist in some states, shielding commercial Bitcoin mining from issues such as inflated electricity charges and community complaints about noise. Miners validate transactions on the Bitcoin network, giving them a level of control over the protocol, and the U.S. is keen to maintain its global leadership - especially given that, as of 2022, the University of Cambridge estimated that 40% of global mining occurred in the United States.

Regulators should quickly establish standards for stablecoins. Questions like what qualifies as a stablecoin, how they can be issued, and the types of acceptable collateral need clear answers. With PayPal Holdings Inc launching its own stablecoin and Stripe acquiring a stablecoin platform for $1.1bn, the payment industry clearly sees the potential of these tokens.

A more crypto-friendly U.S. Congress

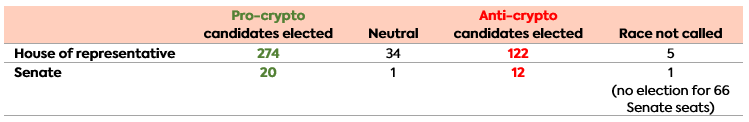

The crypto industy played a significant role in shaping the recent elections. It spent $135mn to support about 50 publicly crypto-friendly congressional candidates from both parties, with nearly all of them winning their races. notably, Bernie Moreno (Republican) defeated the incumbent Senator Sherrod Brown (Democrat) in Ohio - an outcome influenced by $40mn of crypto funding aimed at removing Brown, who has pushed for strict oversight of crypto firms while he chaired the Senated Banking Committee.

Some industry groups like Stand With Crypto help track the candidates' crypto views. As of 15 November 2024, while not all results have been released yet, the chief legal officer of Coinbase Global Inc has already stated that "we now have the most pro-crypto Congress in history"

The strategic Bitcoin reserve

Senator Cynthia Lummis (Republican) has called for the U.S. to create a strategic Bitcoin reserve. Under her Bitcoin Act, she proposed that the United States build a reserve of 1 million BTC over five years, akin to building a gold reserve. The $7tn balance sheet of the Fed would be used to acquire the Bitcoin.

To be complete, the United States already holds some Bitcoin, worth currently ~$18bn. An estimate of this holding can be found on the website of Arkham, a blockchain analysis firm. The authorities confiscated and seized these assets because they were linked to various criminal activities.

It remains unclear if Trump would create such a strategic reserve. On Polymarket, the prediction market operating on Polygon (a layer-2 of Ethereum), the expected probability of seeing the creation of a national Bitcoin reserve before the end of April 2025 currently stands at 31%. Although this probability seems high given the timeframe, Polymarket participants accurately predicted Trump's victory, while traditional polls projected a tight race.

But if a Bitcoin reserve is adopted, the United States would join countries like El Salvador and Bhutan that already hold such reserves. It could trigger a chain reaction among other nations, driving Bitcoin's value to unprecedented levels.

Beyond the impact of elections

Would Bitcoin have surged as much if Harris had won? Nobody knows, but bringing Bitcoin to new records would have required concrete actions, as she was less vocal than Trump on the topic. Still, a clearer regulatory framework was widely expected eventually, regardless of the election outcome.

The price evolution of Bitcoin cannot be summarized just by the evolution of the U.S. regulatory framework. Other factors influencing Bitcoin's price include interest rates and systemic liquidity. The Fed changed its monetary regime earlier this year, and this regime is supportive of the asset class.

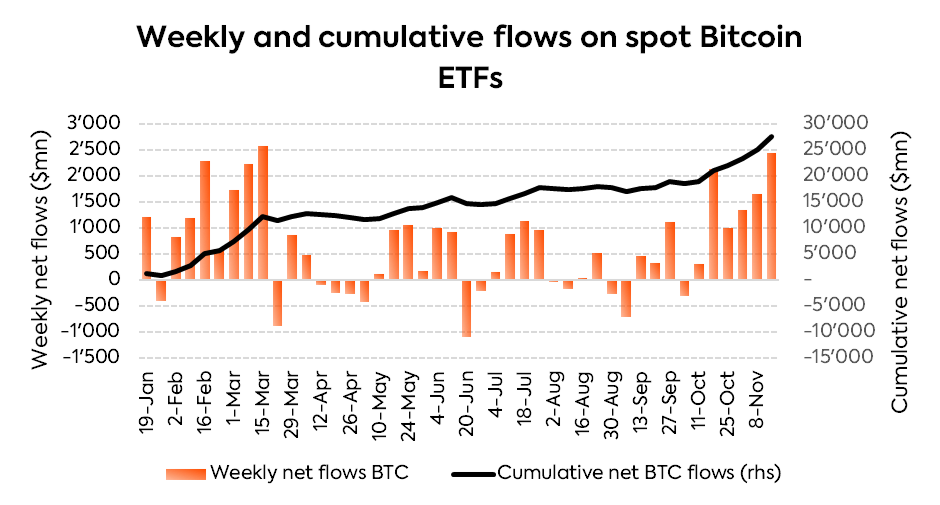

In addition, capital flows into Bitcoin, driven by the approval of the U.S. Bitcoin ETFs, brought $27bn in fresh investments this year. With U.S. retirement assets totaling $40tn, these flows are just a drop in the ocean - many institutions are still waiting for clearer regulatory conditions or finalizing processes to invest in crypto.

Our Takeaway

In the short term, we recommend that investors consider strengthening their allocation to this asset class, particularly during any market dips. Next year, the primary question will be if these catalysts are enough to alter Bitcoin's 4-year cycle. However, the long-term outlook appears stronger than ever, as the United States positions itself to become a leading force in the blockchain ecosystem.

We repeat that the crypto industry is in the "institutionalization phase" and will jump into the "mass institutionalization phase" with clearer regulations on the horizon in the United States. Moreover, the disussion of a potential Bitcoin reserve could introduce sovereign investors into the space, marking a significant milestone. The legitimacy of cryptocurrencies can no longer be questioned.

At a strategy level, we have made minor adjustments following the recent rally. Specifically, we have reduced idiosyncratic risk by limiting exposure to certain individual stocks. We've also reviewed and diversified our holdings in Bitcoin miners and exchanges. While we continue to seek opportunities, we remain committed to maintaining a portfolio that is highly sensitive to cryptocurrencies, given the ongoing bull cycle and their current low correlation with the broader market.