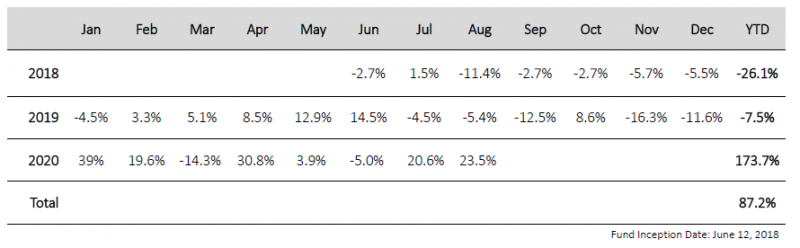

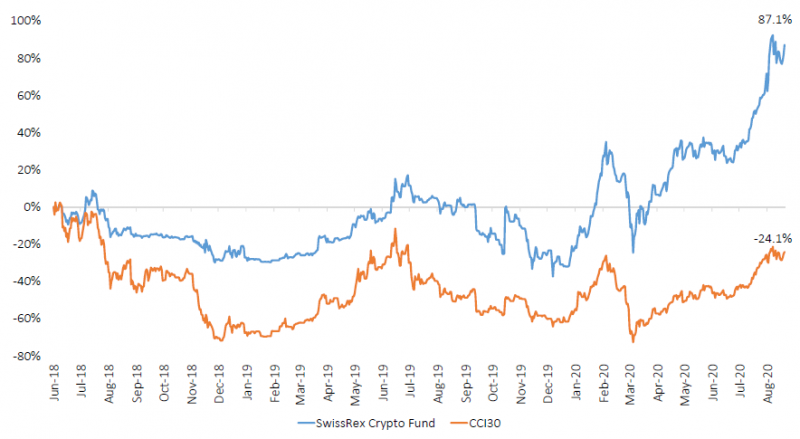

SwissRex Crypto Fund finished the month with a net performance of +23.5% and at a new all-time high.

Asset Allocation

Decentralized finance was by far the best crypto sector, but shortly after the cut-off date, this bubble burst. A calming of this segment was overdue, but it has also affected the rest of the market. New technologies are often over-estimated in the short-run, but under-estimated in the long-run. The wheat should now be separated from the chaff.

We saw the increasing risks of a setback in the DEFI sector. Nonetheless, the exposure was only slightly reduced to 95%, as we believe that we are in a bull market. The correction should be short and could give us the opportunity to increase investments in DEFI at a reasonable price.

Bitcoin was one of the biggest laggards, as investors preferred DEFI, including ETH.

Selection (new positions communicated with a one month lag):

WAVES almost tripled in August as its USD stablecoin, which yields more than 10%, can now also be staked on Ethereum. The position was cut in half to take profits. FTT profited from the DEFI boom as FTX.com started to airdrop SERUM tokens, which are used to build a decentralized exchange.

The long awaited project Polkadot has started in August and seems to attract many developers in very short time. This is heavy competition for other smart contract platforms such as Tezos, which is why the position was reduced again.

Due to the hype around DEFI, the centralized crypto exchanges have fallen somewhat into oblivion, although they generate very high volumes and profits. As profits are used for buy-backs, their token supply is highly deflationary. The position in Binance was increased.

Ethereum is currently the largest position of the fund.

General Notes

In our opinion, the crypto bull market has started. Therefore, we will leave the exposure at about 100%. We see a loss of confidence in central banks, inflation fears and negative interest rates as major demand drivers for this bull market. This is also reflected in our customer group, which is increasingly moving into the institutional sector.

SwissRex Crypto Fund Strategy

The fundamental analysis of crypto tokens built up by SwissRex forms the basis for the investment decisions of the actively managed SwissRex Crypto Fund. The strategy gives the investor access to a diversified basket of Bitcoin and Altcoins (alternative coins). The tokens are analyzed on a daily basis and the positioning is actively managed. More information on the strategy here.

- SwissRex Crypto Fund (Factsheet)

- Monthly liquidity, next cutoff date September 28

- Minimum investment CHF 10'000

- Can be bought with Swissquote or Pictet

- SwissRex Tracker Certificate (Factsheet)

- Monthly liquidity, next cutoff date September 24

- Minimum investment 10 units, price per unit currently at CHF 1'900. Price updates on finanzen.net. Let us know if you wish to get a price update ahead of the cut off

- Can be bought with any bank

Both products are distributed by Crypto Consulting AG in Switzerland to qualified investors. Factsheet and registration for the newsletter on www.cryptoconsultingag.com.

Contact: Désirée Velleuer, dv@cryptoconsultingag.com