What happened

On 15 October, ASML issued an unusual profit warning. The company cut its sales guidance for 2025 due to pre-orders for the thurd quarter being 50% below expectations. The stock lost 15% the following trading session, taking down the entire semiconductor sector, with the iShares PHLX Semi losing over 5%.

Impact on our Investment Case

U.S.-China shenanigans, or is it?

Many in the market attributed this widely unexpected slowdown to the China effect. The U.S. is indeed pressuring Western companies and governments to shutter China's access to the technology necessary to produce cutting-edge semiconductors at a large scale. However, considering that EUV technology - the most advanced and profitable one for ASML - has been banned for Chinese customers since 2019, this can hardly be considered a surprise, and even a ban on lower-end technology would follow the same logic.

In our view, investors are just waking up from their AI-infused dream. The emergence of ChatGPT in November 2022 triggered a frenzy in hardware, which is indeed the base building block of the technology. Nvidia's meteoric rise initiated a massive FOMO. However, we started to see some excess, with investors starting to chase increasingly remote derivatives of the core trend, leading to a rapid rise in valuation multiples for the entire segment. The truth is, outside of a few AI-focused players, semiconductor players exposed to the broader economy are currently facing mixed perspectives, as highlighted by recent disappointments from players such as STMicroelectronics exposed to the automotive market.

Focusing on what matters

AI does need cutting-edge chips, but this is far from the only segment using chips. Given the ubiquity of electronics in our modern world, investing in semiconductor equipment means being exposed to the broader economy. This is why, over the past year, we chose to focus exclusively on AI specialists providing chips used for training (e.g., Nvidia) and inference (e.g., Marvell) workloads, exiting more generalist players.

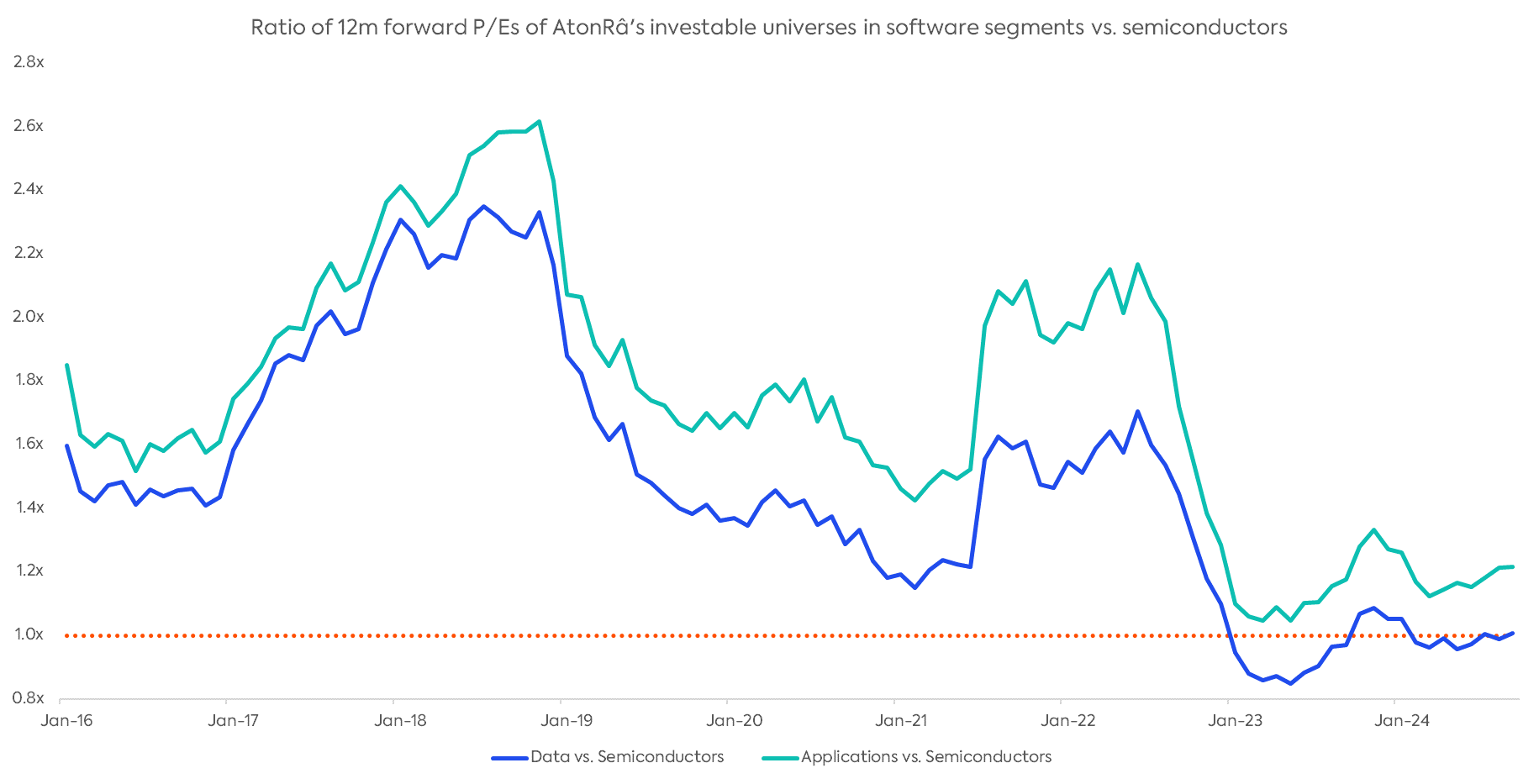

The portion previously allocated to those generalist semiconductor players has been reinvested in data players. Those provide the critical software infrastructure for AI and are currently being neglected by investors, as highlighted by the chart below, where valuation multiples have experienced a historical shift in favor of hardware. Investors have been shunning software players since Salesforce's profit warning last May, but are missing a critical piece of the puzzle. We also pivoted towards applications using AI as a differentiating competitive advantage, notably in productivity, health, and safety, for which structurally profitable and fast-growing players can already be found.

Ultimately, investors should be concerned about how AI can be monetized, as capital is allocated to generate some return. We believe that lately, investors have been missing the forest for the trees, leading to inflated valuations for hardware players while those of software companies that directly or indirectly facilitate the monetization of AI have never been so relatively attractive. In this regard, we believe our current allocation, favoring software players but also integrating specialist AI chipmakers, is perfectly positioned for what we see as an incoming market shift.

Our Takeaway

We believe that the moment of truth has arrived, and that the market will become more selective from now on. Blindly investing in semiconductors without realls understanding the stakes will backfire on some investors. As a result, the good performance of the Nasdaq and the major technology funds, supported by the big semiconductor companies, may run out of steam. Smaller specialized companies are bound to benefit, and will be boosted by additional cuts in interest rates, further favoring strategies like ours.