What happened

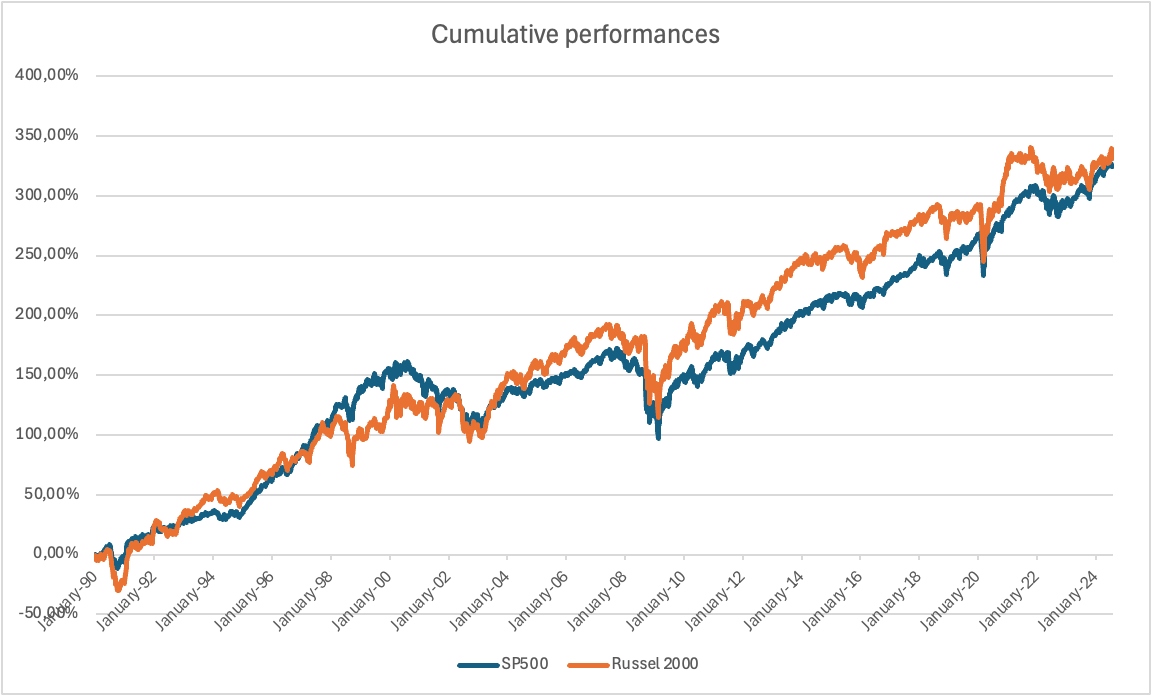

In July, there was a significant shift in the relative performance of U.S. small- & mid-cap stocks (referenced as Russell 2000 components) compared to large caps (referenced as SP500 components). While fluctuations in relative performance are common in the markets, this particular move was clearly noticeable. The Russell 2000 outperformed the S&P 500 by 12% over three weeks - the strongest such move since at least 1990. For context, the previous record for a similar three-week outperformance by the Russell 2000 dates back to February 2000, at the peak of the dot-com bubble. This raises the question: is this a short-term spike in volatility or a signal of a potential shift in the multi-year trend?

Impact on our Investment Case

When Do Small & Mid Caps Usually Outperform?

Historically, smid-cap stocks tend to outperform large caps during periods of economic recovery and expansion. For instance, during the post-2008 recovery, the Russell 2000 significantly outpaced the S&P 500 from 2009 to 2013.

Source: Refinitiv/Eikon, atonra

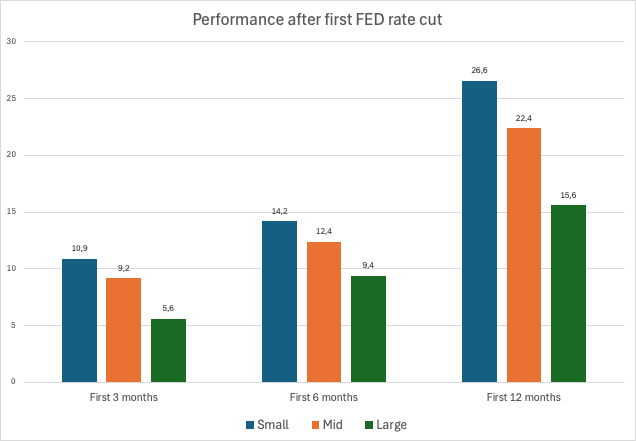

This outperformance is often driven by smaller caps' greater sensitivity to economic growth, which allows them to capture more upside in favorable economic conditions. Moreover, in low-interest-rate environments, such as the one from 2008 to 2015, smaller caps benefit from cheaper financing, which supports their growth. SMID-cap indices, such as the Russell 2000, usually also offer exposure to higher-growth companies, that tend to lead during these periods. Also, empirically, SMID-caps outperform large-caps following the first cut in interest rates by the FED (chart based on data since 1954).

Source: Federal Reserve Board, Haver Analytics, Center for Research in Security Prices, The University of Chicago Booth School of Business, Jefferies, William Blair, as of 10/31/2023. Data presented covers the period since 1954.

Current Situation: Why the Underperformance?

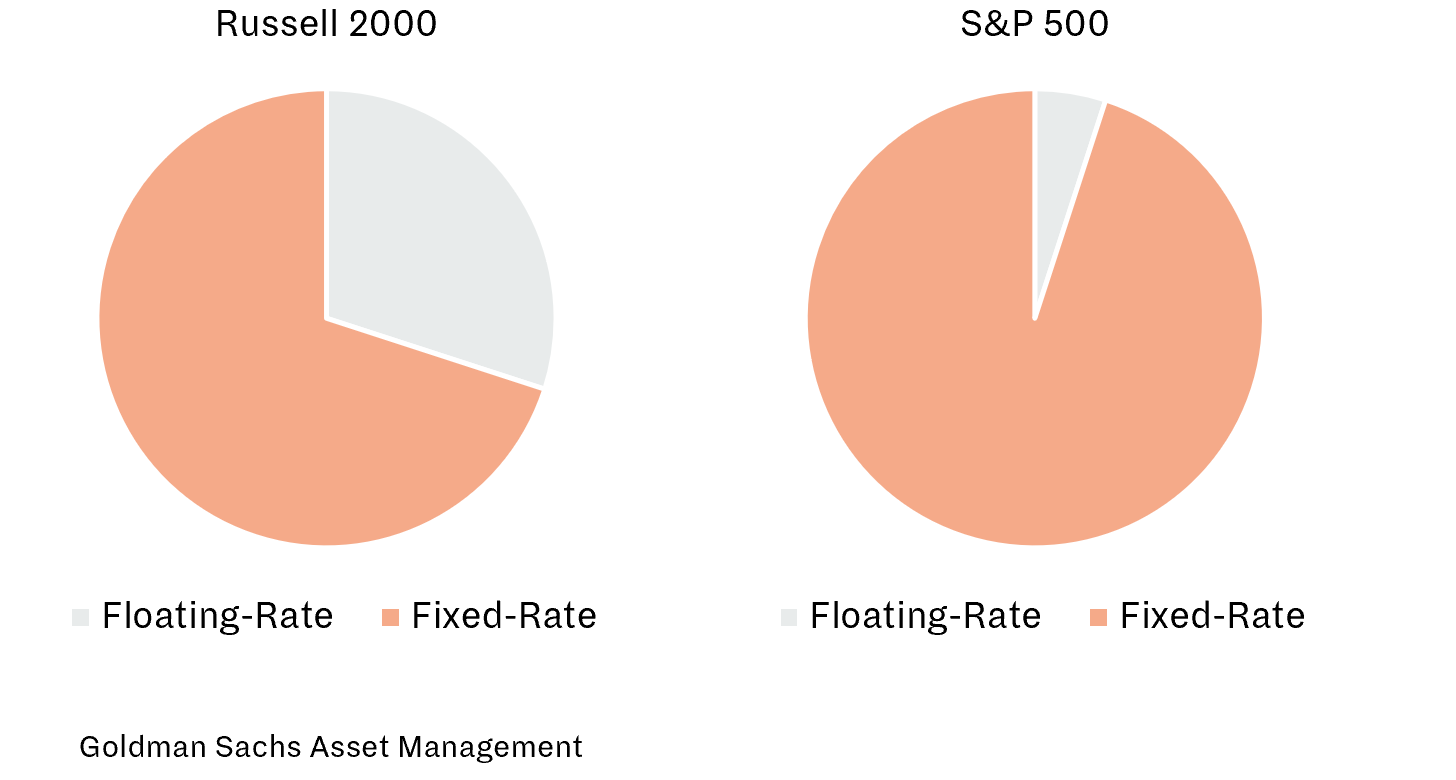

Recently, smaller-cap stocks have lagged behind larger-caps, and several factors have contributed to this trend. Beyond the hype surrounding the so-called "Magnificent 7" tech stocks, fundamental issues have played a role. Rising interest rates have disproportionately impacted smaller caps, which typically have higher levels of floating-rate debt. For example, according to Goldman Sachs, about 30% of debt in the Russell 2000 is tied to floating rates, compared to just 6% in the S&P 500. This higher sensitivity to interest rates has weighed heavily on small caps.

Furthermore, the economic outlook (notably for the U.S. economy) has been mired in uncertainty: expectations were for the economy to tank into recession, although the actual data came as a surprise to most market participants. Still, the relative performance of the rest of the world has mostly been better than that of the U.S., helping larger caps that benefit from global exposure.

Catalysts for Future Outperformance

Despite recent underperformance, several indicators suggest that SMID-cap stocks could be poised to invert the trend. Currently, SMID-caps are trading at a significant discount to large caps, with trailing P/E ratios for small caps currently more than one standard deviation below their long-term median, according to JPMorgan's research. Historically, such valuation gaps have often preceded periods of SMID-cap outperformance. While valuations can remain depressed for extended periods, potential catalysts are on the horizon. If the Federal Reserve begins cutting interest rates in response to slowing inflation, the heavily leveraged SMID-caps could benefit significantly. Additionally, as some forecasts suggest, if the U.S. economy begins to outpace Europe and Asia, this could favor SMID-caps due to their greater domestic focus.

Our Takeaway

In conclusion, while small caps have faced challenges recently, data-driven insights suggest that improving economic conditions, potential rate cuts, and a favorable valuation environment could set the stage for a period of strong outperformance in SMID-cap stocks. All our investment strategies are well-positioned to benefit in such a scenario. By design, we have greater exposure to mid and small caps rather than very large caps, as we aim to capture thematic views through focused (expressed as purity) investments. Moreover, we prioritize companies with solid financials, leading competitive positions, and high barriers to entry, which are likely to lead their sectors and drive our portfolios' outperformance.